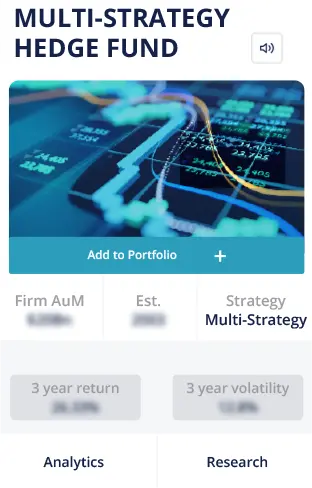

The Portfolio-Centric Alternative Investment Platform

Financial advisors can seamlessly customize portfolios of

industry-leading

alternative investment funds with low minimums and

operational simplicity.

Get Started

30

Years of Alternative

Investment Experience

+200

Financial Advisory Firms

in our Network

+500

Bespoke Portfolios Created

through our Platform

~50

Curated Private Equity, Private Credit, Venture Capital, & Hedge Funds

Value Proposition

Differentiate Your Offering

Compete with highly resourced wealth management firms to enhance client outcomes and win business by offering unique investment strategies.

Private Fund Access

With low investment minimums relative to going direct, your clients can gain exposure to approximately 50 alternative investment funds that are among the largest and most recognized in the industry. Our manager selection process is transparent, meaning we have never and will never be paid for distribution.

An Integrated Solution

Our platform is here to simplify, complement, and enhance your operational workflows. Your clients will subscribe to multiple fund exposures with a single, one-time electronic sub doc, and receive consolidated account statements, audits, K-1s, capital calls, and distribution notices.

Transparent Source of Capital

We have never and will never charge fees to the managers on the platform.

Diversified Source of Capital

Gain access to a large and growing niche of advisors and their investors.

Consolidated Filing

One end client as opposed to hundreds of individual LPs through both our onshore and offshore Titan Capital Funds Master LP Feeder Structure. This means one recipient of K1s, account reporting, capital calls, distributions, etc.

Institutional Experience Meets the Modern Tech-Enabled World

Founded in 1994, Titan Capital has been an active investor in the private fund ecosystem, allocating to many of the industry's largest and well-respected names. While our core competencies stem from traditional fund of funds, the business has evolved into a technology company, providing our advisory network with a centralized system to source, build, manage, and maintain institutional-caliber, alternative investment portfolios.

A Cryptocurrency Investment Solution for the Modern Advisor

Our platform is designed specifically for cryptocurrency investing, providing all the tools you need to add digital assets to your client’s portfolios. Easily browse cryptocurrency managers, compare digital funds, create client-facing proposals, and manage crypto portfolios over time.

Get Started

Registration

Qualification

View Funds

Build Portfolios

Manage Portfolios

Unlock the Power of our Alternative Investment Platform

Join our advisory network and learn how you can maximize your clients’ investments with our platform.